In the digital age, where “blockchain” seems to be on everyone’s lips, understanding this revolutionary technology is more important than ever. But fear not, intrepid explorer! This article will demystify the lingo, unravel its potential, and lay bare its challenges, leaving you equipped to navigate the exciting world of blockchain.

What is blockchain?

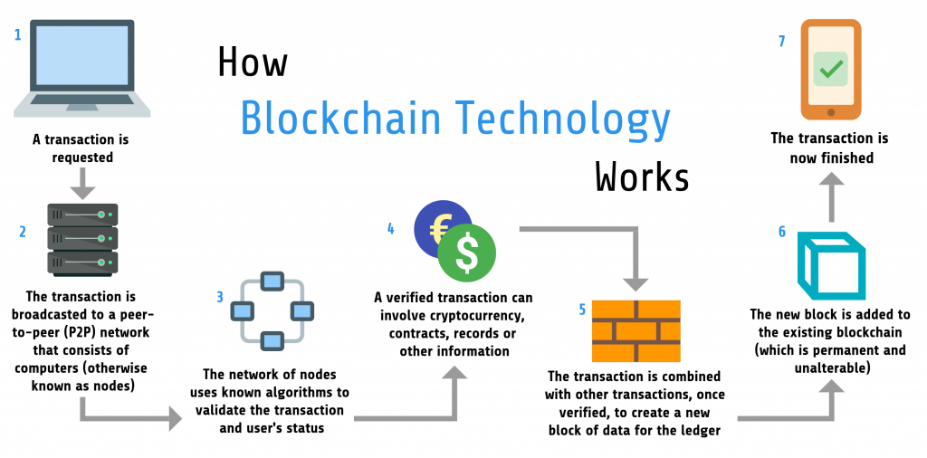

Imagine a digital ledger, publicly accessible and transparent, where every transaction is recorded in an unalterable chain of blocks. Each block is linked to the previous one, creating a tamper-proof record of data that cannot be erased or forged. This, in essence, is the magic of blockchain.

But how does this translate into real-world uses?

The possibilities are as diverse as human ingenuity itself! Here are just a few examples:

- Secure transactions: From cryptocurrencies like Bitcoin to streamlining supply chains, blockchain ensures secure and transparent financial transactions, reducing fraud and errors.

- Decentralized voting: Imagine elections where every vote is recorded immutably, eliminating the risk of manipulation and boosting trust in the democratic process.

- Improved healthcare: Securely storing medical records and tracking medication distribution can revolutionize healthcare, ensuring patient privacy and streamlining processes.

- Enhanced intellectual property: Protecting creative works like music or art becomes a breeze with blockchain’s ability to track ownership and prevent plagiarism.

Advantages that make blockchain shine:

- Security: Its decentralized nature and cryptographic safeguards make it incredibly secure and resistant to hacking.

- Transparency: All transactions are publicly visible, fostering trust and accountability.

- Efficiency: Automating processes and eliminating intermediaries can save time and money.

- Immutability: Data cannot be altered or deleted, ensuring a reliable and tamper-proof record.

Technology, blockchain has its challenges:

- Scalability: Processing a high volume of transactions can be slow and energy-intensive.

- Complexity: Understanding and implementing blockchain technology requires specialized skills.

- Regulation: The legal framework surrounding blockchain is still evolving, creating uncertainty.

- Energy consumption: Some consensus mechanisms like proof-of-work require significant energy resources.

what are the 4 different types of blockchain technology?

Blockchain technology is revolutionizing everything from finance to healthcare, but not all blockchains are created equal! Understanding the 4 main types is crucial to navigating this dynamic space.

Public Blockchains

Think Bitcoin and Ethereum – open to anyone, anywhere, with complete transparency. Anyone can join, verify data, and participate in the network. This open access fosters innovation and community ownership, but can also lead to slower transaction speeds and security vulnerabilities.

Private Blockchains

Think permissioned, enterprise-grade networks. Controlled by a single entity or consortium, these offer enhanced security and privacy, ideal for sensitive data or internal operations. Think supply chain management or interbank settlements. While faster and more secure, they sacrifice the decentralization and transparency that defines public chains.

Consortium Blockchains

Imagine a hybrid approach. Multiple pre-approved organizations jointly manage the network, combining the benefits of both public and private models. Think healthcare consortiums sharing patient data securely or logistics networks tracking goods efficiently. This balance offers flexibility, but requires careful governance and trust between participating entities.

Hybrid Blockchains

Blurring the lines even further, hybrid chains bridge the gap between public and private realms. Public data might be accessible, while sensitive transactions remain confidential. Think voting systems or intellectual property management. This adaptable approach offers customized solutions, but complexity can arise in managing different access levels.

Blockchain Technology in Banking: Revolutionizing Transactions, One Block at a Time

The stoic image of traditional banking is being chipped away at by blockchain technology, the innovative force behind cryptocurrencies that’s now disrupting the financial landscape. But how exactly is this digital ledger system transforming the way we bank? Buckle up for a glimpse into a future where transactions are faster, cheaper, and more secure.

Imagine a world where:

- Cross-border payments are instant and hassle-free: No more waiting days for funds to clear. Blockchain’s secure and transparent network eliminates intermediaries, slashing processing times and transaction costs. Think sending money to loved ones abroad as easily as sending an email!

- Fraud and errors become a relic of the past: Every transaction is meticulously recorded on a tamper-proof, distributed ledger, making it virtually impossible to manipulate or forge records. Say goodbye to fraudulent activities and human error!

- Securities trading gets a major upgrade: Tokenizing assets like stocks and bonds streamlines the trading process, reducing paperwork and settlement times. Think buying and selling shares with the same ease as online shopping!

- Smart contracts automate the mundane: These self-executing agreements based on predefined conditions take the hassle out of routine tasks. Imagine loan approvals happening automatically when creditworthiness criteria are met, or insurance claims being settled instantly upon verification.

But it’s not just about efficiency. Blockchain empowers individuals by giving them greater control over their financial data. With decentralized identity solutions, you can choose what information you share with banks and other institutions, reclaiming your privacy in the digital age.

Of course, there are challenges to overcome. Scaling blockchain technology for mass adoption requires innovative solutions, and regulatory frameworks need to evolve to keep pace with this rapidly changing landscape.

But the potential is undeniable. Blockchain is poised to revolutionize the banking industry, making it more efficient, secure, and accessible for everyone. So, the next time you think about banking, remember, the future is built on blocks, and it’s looking brighter than ever.

Sectors of Blockchain technology

Here are some of the key areas where blockchain technology is having a major impact:

Finance

his is where blockchain first gained widespread attention, with its use in cryptocurrencies like Bitcoin and Ethereum. However, blockchain is also being used to revolutionize traditional financial services, such as cross-border payments, trade finance, and securities trading.

Supply chain management

Blockchain can be used to track the movement of goods and materials through a supply chain, providing greater transparency and efficiency. This can help to reduce fraud, improve inventory management, and ensure the quality of products

Healthcare

Blockchain can be used to securely store and share medical records, which can improve patient care and reduce fraud. It can also be used to track the provenance of pharmaceuticals and medical devices, ensuring their authenticity and safety.

Voting and elections

Blockchain can be used to create secure and transparent voting systems, which can help to reduce fraud and increase voter confidence.

Identity management

Blockchain can be used to create decentralized identity systems, which can give individuals more control over their personal data and make it easier to verify their identity online.